mass tax connect estimated tax payment

Complete the information on the next page personal information bank information payment amounts and due dates. With MassTaxConnect you can.

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Massgov has a very user-friendly online resource called TaxConnect that provides information about your state taxes.

. Under Quick Links select Make a payment in yellow below. Your support ID is. This form is available at.

Select the Individual payment type radio button. Failure to make correct. Your support ID is.

Use this link to log into Mass Department of Revenues site. Open link httpsmtcdorstatemausmtc_ From this page click on the Make a Payment tab then youll be prompted to log in to your account. This video tutorial gives you an overview of the MassTaxConnect system including how to set up an account andor log in.

Please enable JavaScript to view the page content. Individuals and businesses can make estimated tax. Review your payment and select Submit.

Individual taxpayers can make bill estimated extension or return payments on MassTaxConnect without logging in. How to pay Massachusetts taxes. Individuals and fiduciaries can make estimated tax payments with MassTaxConnect.

Visit DOR Personal Income and Fiduciary estimated tax payments for more information. Calculate Estimated Tax Penalty Form M. Paid in full on or before the 15th day of the third month of the corporations taxable year or.

Please enable JavaScript to view the page content. Form 1-ES is a Massachusetts Individual Income Tax form. Access account information 24 hours a day 7 days a week.

Skip to Main Content. Call 617 887-6367 for information on the payment agreement up to 5000 and 617 887-6400 for 5001 or more. Please enable JavaScript to view the page content.

From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section. ONLINE MASS DOR TAX PAYMENT PROCESS. Your support ID is.

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Youll learn how to pay a tax bill or make an extension or estimated tax payment using the Make a Payment feature. Calculate Late File and Pay Penalty.

Enter the taxpayers name. To pay the ELT practice owners will add this tax to their account at MassTaxConnect at httpsmtcdorstatemausmtc_. Please enable JavaScript to view the page content.

Your support ID is. Make estimated tax payments online with MassTaxConnect. If youre in a new business and not yet earning income you dont have to start paying estimated taxes until you do generate some even if you believe youll be getting income later in the year.

Set up a payment agreement If you owe 5000 or less. Do more with MassTaxConnect. To report the ELT practice owners will complete and submit a Form 63D-ELT with Mass Dor.

Tax payments can be made on MasstaxConnect with. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money that is not subject to withholding such as self employed income investment returns etc are often required to make estimated tax payments on a quarterly basis. All corporations that reasonably estimate their corporate excise to be in excess of 1000 for the taxable year are required to make estimated tax payments to Massachusetts.

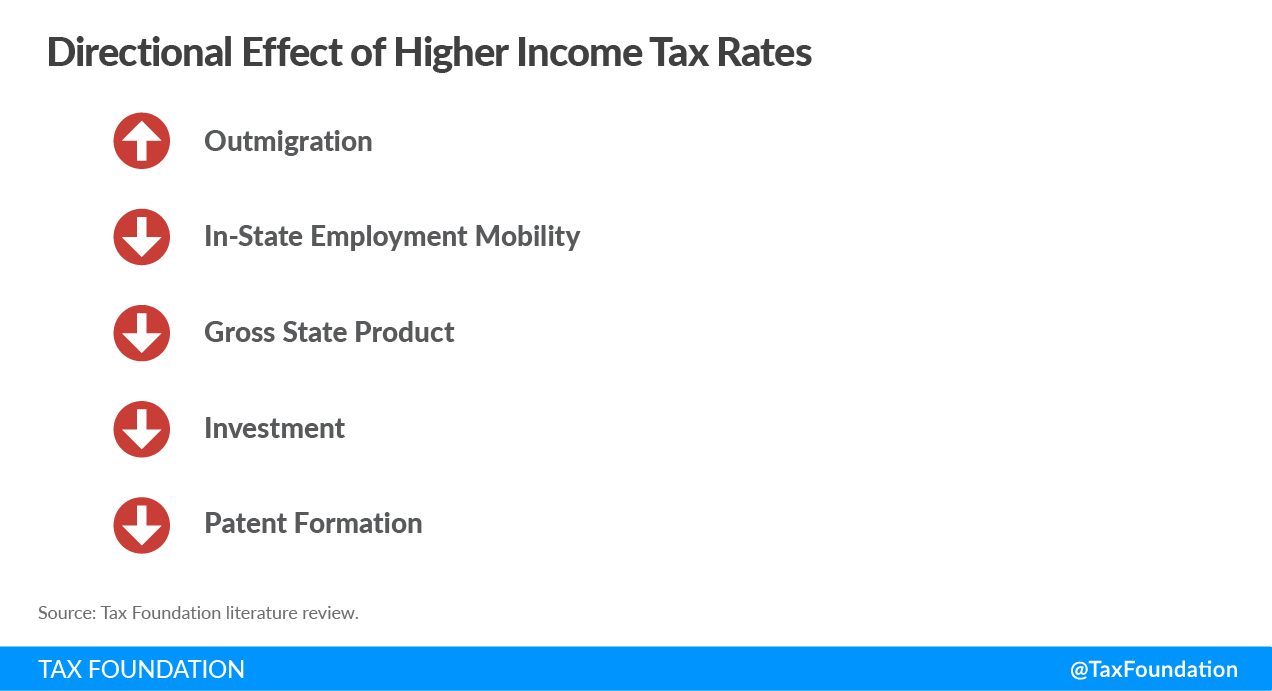

Estimated tax payments are generally due four times a year on April 15 June 15 and September 15 of the current tax year and January 15 of the following tax year. You do no need an account. Choose the amount you want to pay and your payment method and select Next.

Enter your SSN or ITIN and phone number in case we need to contact you about this payment Choose the type of tax payment you want to make and select Next. Select individual for making personal income tax payments or quarterly estimated income tax payments. Fiduciary tax payments can also be made on the website but an account with log in information is needed.

Estimated taxes must either be. Paid in four installments according to the schedule below.

Masstaxconnect Resources Mass Gov

Massachusetts Income Tax H R Block

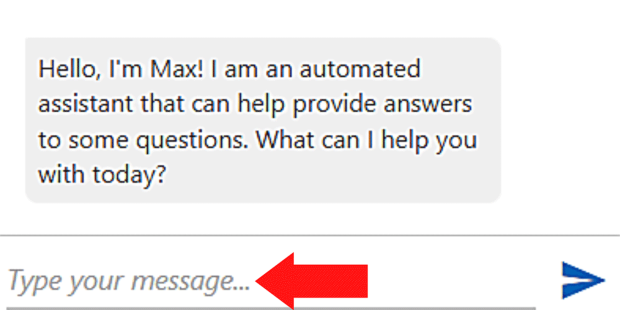

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Massachusetts Income Tax Calculator Smartasset

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Tax Guide For Pass Through Entities Mass Gov

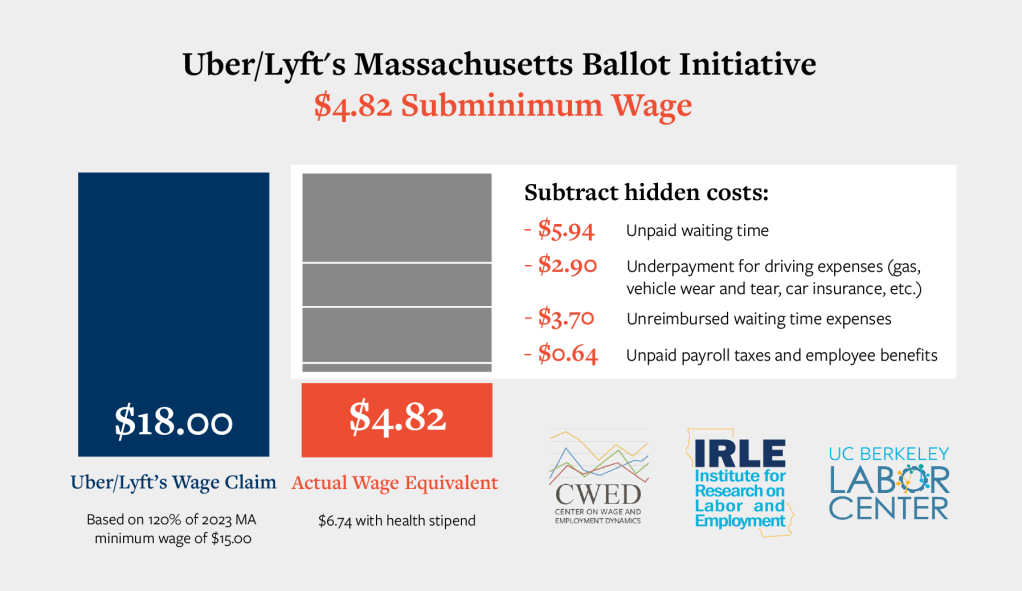

Uc Berkeley Finds Gig Workers Could Earn 4 82 Per Hour If Ma Ballot Proposal Passes Techcrunch

Masstaxconnect Resources Mass Gov

Advance Payment Requirements Mass Gov

Mobile Concept Tax Prep For The Modern Worker Tax Prep Mobile App Design Tax App

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Prepare And E File Your 2021 2022 Ma Income Tax Return

Massachusetts Sales Tax Information Sales Tax Rates And Deadlines